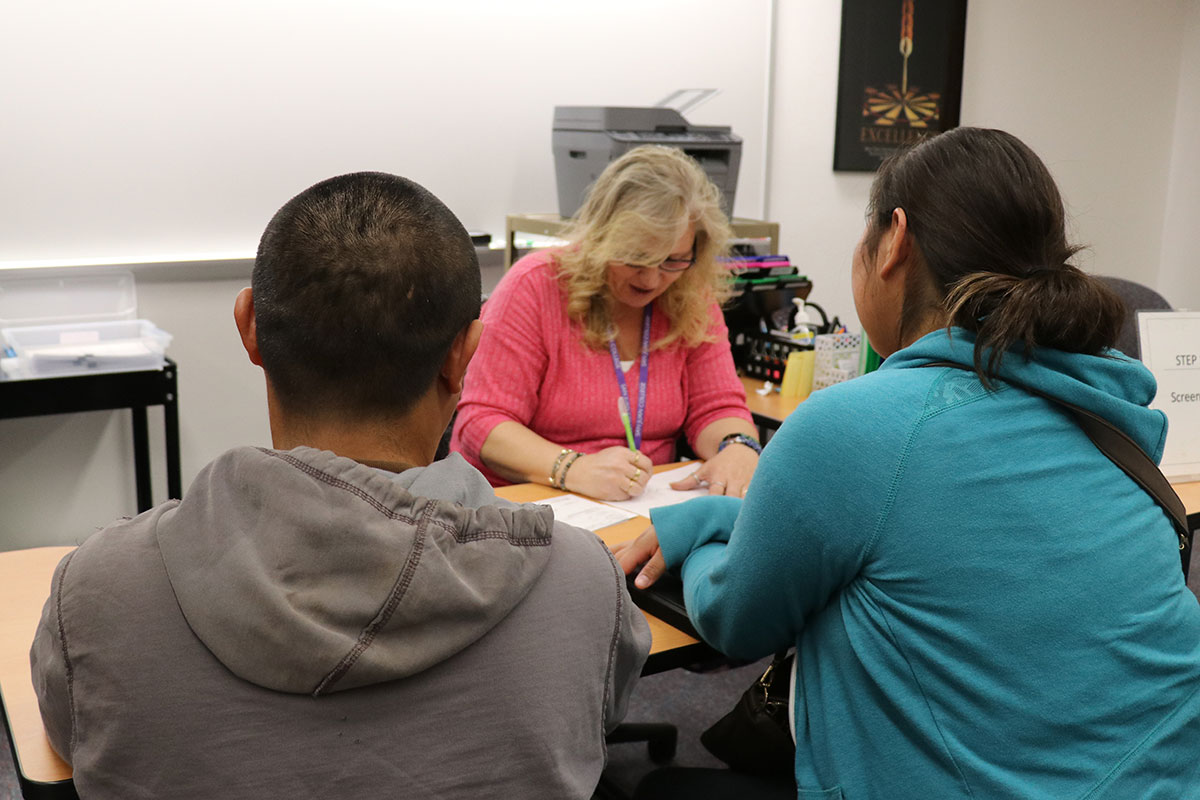

Low Income Taxpayer Clinic

The Four Corners Low Income Taxpayer Clinic (LITC) at San Juan College helps low-income families or individuals who speak English as a second language resolve any tax disputes they may have with the IRS. Examples of tax dispute issues the LITC can help with are audits, appeals, tax collection, and occasionally, can represent taxpayers in court.

You have a dispute with the IRS if:

- The IRS is asking you to provide support for a deduction or credit claimed on your return;

- The IRS has denied a deduction or credit claimed on your return;

- The IRS has issued a "Notice of Deficiency" and you have 90 days to petition the U.S. Tax Court;

- You can't pay an existing IRS debt; or

- You owe income tax for a year in which you were married to an abusive spouse.

If you received a letter from the IRS, here are some tips:

- Read the letter immediately;

- Call the IRS if you have any questions;

- Learn your rights by reading IRS publication 1;

- Document everything and NEVER miss a deadline while you are waiting for the Clinic or anyone else to represent you.

Am I Eligible?

Yes if the total income of your "family unit" is not more than the maximum shown below.

A family unit is either:

- You and those who live with you; or

- You alone, if you do not live with someone related by birth, marriage, or adoption.

- Unrelated individuals living together are considered separate "family units."

Call (505) 566-3747 to schedule a phone or in-person intake interview.

There is no charge for our services. Generally, the IRS and the U.S. Tax Court will waive or lower fees for low-income taxpayers. You are responsible for any fees charged by the IRS, New Mexico Tax & Revenue, or the U.S. Tax Court.

The Low Income Taxpayer Clinic serves all of the Four Corners area — in-person or by phone, fax, email and Skype, as appropriate. Its physical location is within the San Juan College School of Business located at 4601 College Boulevard, Farmington, New Mexico, 87402.

Hours by appointment only. Please call (505) 566-3747 to schedule your appointment.

Although the grantee receives funding from the IRS, the clinic, its employees, and its volunteers are not affiliated with or endorsed by the IRS or its employees. A taxpayer’s decision to obtain representation from an LITC will not result in the IRS giving preferential treatment in handling the dispute or problem and will not affect the taxpayer’s rights before the IRS.